The financial world is buoyed by optimism as commodities appear to no longer be the drag on OECD economies as they were the decade heretofore. Reading the news and following financial indexes one gets the sense of an imminent return to the exuberance of the decades that followed the Plaza Accord.

But is at all that good? Has the planet suddenly grow bigger and multiplied its resources? Have all the planetary geo-political issues gone away with the accord on Iran?

The press hastens burying deep any hint of "peak oil", but for some it is not just an idea, it is quite real. Mexico is one of the most spectacular examples of the rise and fall of an economy based on the extraction of fossil resources; there is much to learn from this country.

BloombergThe much lauded "shale oil" industry is clearly in a downturn, with a very visible slowdown in the number of wells coming on line. Extraction rates are already declining and in the near future this trend can only accelerate.

Mexico Energy Reform Starts With Thud in Offshore Oil Auction

Adam Williams, Andrea Navarro and Eric Martin, 15-07-2015

Mexico’s first auction of offshore oil leases fell short of the country’s expectations as several majors decided not to participate.

Only two of the 14 shallow-water blocks released on Wednesday received qualifying bids. Exxon Mobil Corp., Chevron Corp. and Total SA passed on the country’s sale of territory in the Gulf of Mexico, 77 years after the country nationalized crude. The 14 percent success rate was less than half the 30 percent to 50 percent goal that the government said would be its minimum for judging the event a success.

The auction was the first in a series that will help determine whether Mexico can reverse a decade-long decline in crude output and fulfill President Enrique Pena Nieto’s pledge to double the speed of economic growth. The output drop and an almost 50 percent plunge in oil prices during the past year had already forced Mexico to trim government spending and sweeten the contract terms for prospective bidders.

ReutersAnd this decline in extraction brings up again the spectre of a serious default wave in the US bond market. News of bankruptcies are becoming more frequent but for the moment the American banking industry seem willing to keep the boat afloat. However, their exposure to the "shale oil" wreck is starting to raise eyebrows at the highest level.

North Dakota oil well completions slow sharply

John Kemp, 22-07-2015

No new well completion reports have been filed in North Dakota since July 10, the longest gap this year, according to daily activity records published by the state's Department of Mineral Resources (DMR).

Completions, rather than wells drilled, provide the best guide to short-term changes in output, since operators can always delay completing a well and putting it into production, either because they are waiting for completion crews to be available or to wait for better prices.

[...] The DMR estimates that 110 to 120 new wells need to be completed each month to maintain state oil output at its current level of 1.2 million barrels per day.

According to the latest state report, 102 wells were completed in April and 114 in May, though the May figure is preliminary.

The number of wells reported completed so far in July is running far below the previous level and well below the number the DMR estimates is needed to hold production steady.

WolfStreet.comThe shale sub-prime has not gone away, it is still there, even if banks gave it six extra months of breathing space. As are still there the risks it poses to the wider economy.

It's Happening: Debt Is Tearing up the Fracking Revolution

Wolf Richter, 21-07-2015

The Office of the Comptroller of the Currency has been warning the banks it regulates about these oil & gas loans. Their collateral has plunged with the price of oil and gas. And as banks begin to fret while investors lick their wounds, after all these years, a strange phenomenon in the world of ZIRP is showing up on the horizon: a cash crunch.

Devastating for the permanently cash-flow negative shale revolution.

Most drillers survived the last redetermination by their banks of their oil & gas credit lines. That was in April. These loans are backed by the value of the drillers’ reserves. But low oil and gas prices have knocked down that value, and drillers had to pay down their credit lines with money extracted from other investors. That’s where some of the new money went that drillers have raised.

The next redetermination cycle is in October. And hedges are now expiring which have partially protected drillers’ revenues from the oil price plunge. So it’s going to be tough. But turning off the money spigot will push these companies off the cliff. And banks would end up with the oilfields and have to get their hands dirty. So they’re not eager to pull the ripcord. But they can’t afford to play this “extend-and-pretend” charade for too long either, or else they’ll get sucked down too.

OtterWood CapitalCoal is also being hit by the commodity price rout, again with a particularly deep impact in North America.

Energy defaults are coming

Christine Hughes, 22-07-2015

The problem is debt issued by energy companies when oil prices were high and interest rates were super low are coming due [...]. If oil prices remain low the weaker energy companies will most likely start to default. The fear is this could spread to other areas of the economy.

OilPrice.comRussia is offering a pipeline to Greece, or better said, half a pipeline. The failure of the European Energy policy could not be more strident. It is entirely funded on the successful export of the neo-liberal economic paradigm to all its foreign partners. Not only is that export failing, this paradigm is not being that successful within the EU either.

Bankruptcies Starting To Pile Up In Coal Industry

James Stafford, 21-07-2015

After decades of strong financial numbers and dominance in the electric power sector, coal producers are starting to fall apart faster than anyone could have anticipated. SNL Financial has produced some jaw dropping data on the quickly deteriorating coal industry, with a horrific performance in the second quarter.

[...] Coal prices are down 70 percent from four years ago. The U.S. is shifting towards natural gas in the electric power sector, and weak demand for coal is leading to mine closures. The Obama administration is also trying to reduce the country’s greenhouse gas emissions, and a litany of regulations intended to meet that objective are cutting down coal at the knees. As the dirtiest source of electricity, coal is in the crosshairs. The EPA is working hard to ensure that its Clean Power Plan, which puts limits on carbon emissions at the nation’s power plants, is finished before the end of Obama’s term.

TASSLong read for the weekend. As usual, there are benefits in reading above the good versus evil narrative often prevailling in the US. However, there are very interesting hints on the forwards and backwards steps the Obama administration has taken in Syrian, apparently without any clear long term strategy for the region.

Greece to confirm construction of natural gas pipeline jointly with Russia — minister

Ruslan Shamukov, 20-07-2015

Greece supports the plan of building a natural gas pipeline jointly with Russia to be an extension of the Turkish Stream gas pipeline, new Minister of Productive Reconstruction, Environment and Energy of Greece Panos Skourletis said on Monday at the ceremony of responsibilities’ handover from the former minister Panagiotis Lafazanis.

Skourletis said the plan of building a new Greek-Russian gas pipeline in the territory of Greece is supported. It opens new opportunities to be used, the minister said.

This pipeline is more beneficial for Greece than the planned Trans-Adriatic Pipeline (TAP), Lafazanis said earlier. "The Russian project will provide more benefits because Greece will own a 50% stake in the pipeline and because tariffs will be higher," the ex-minister added.

Greek state-owned Energy Investments Public Enterprise S.A. (EIPE S.A.) and Russia’s VEB Capital will be partners in the project. Investments into construction will amount to $2 bln. The project will be 100% financed by the Russian side and will make possible to create 20,000 jobs in Greece.

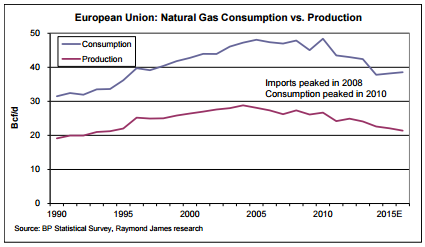

Consortiumnews.comHere is a renewable energy news piece that on the surface might look unrelated. The rapid penetration of PV in the European electricity market rendered a large swath of the Gas power plant fleet uneconomic. These plants made their revenues providing electricity during hours of peak consumption when prices were traditionally higher. These days electricity prices are at their lowest at noon, pretty much from March onwards until November. This decline in gas consumption is of great importance since large volumes are being freed for heating - an area were renewable energy is far from the strides it has achieved in electricity.

The US Hand in the Syrian Mess

Jonathan Marshall, 20-07-2015

Syria’s current leader, Bashar al-Assad replaced his autocratic father as president and head of the ruling Ba’ath Party in 2000. Only 35 years old and British educated, he aroused widespread hopes at home and abroad of introducing reforms and liberalizing the regime. In his first year he freed hundreds of political prisoners and shut down a notorious prison, though his security forces resumed cracking down on dissenters a year later.

But almost from the start, Assad was marked by the George W. Bush administration for “regime change.” Then, in the early years of Barack Obama’s presidency, there were some attempts at diplomatic engagement, but shortly after a civil conflict broke out in 2011, the legacy of official U.S. hostility toward Syria set in motion Washington’s disastrous confrontation with Assad which continues to this day.

Oil & Gas 360Finishing off with more long reading. A thorough and somewhat sceptical account of the Molten Salt Fast Reactor is given - a technology often waged as the definitive solution for a sustainable economy. I find it tragic that research on these technologies largely stopped three decades ago, it might have spared a great deal of worry and sufferance. In spite of encouraging developments with renewable energy, Nuclear remains a technology of the future, perhaps in ways that may not be so obvious at this time and age.

Europe’s Natural Gas Demand Down 22% since 2010 and Falling

21-07-2015

Demand for natural gas has been growing around the world, albeit at a slower pace than many had hoped, but the European market has actually show a decline in natural gas demand since 2010. All other major gas consuming countries have shown increases in demand going back to 1990, but demand from the E.U. has declined 22% since 2010, according to a recent note from Raymond James.

[...] While demand in Europe declines, other major economies continue to consume growing quantities of natural gas. U.S. and Canadian demand has grown 11% since 2010; China has seen demand boom 67%, and many mid-sized economies, including Colombia, Turkey, Egypt and Thailand, are also in the market for more or the abundant resource. Russian demand has stayed relatively stable, but the country consumed more gas than the entire E.U. in 2014 despite having less than one-third of the population.

Energy MattersHave a pleasant weekend.

Molten Salt Fast Reactor Technology – An Overview

Hubert Flocard, 20-07-2015

The world nuclear industry currently runs on Generation II and Generation III reactor technology. The presently active reactors (whether moderated by pressurised water – PWR – or boiling water – BWR) are said to belong to the GII generation while more modern versions such as the EPR or the AP1000 correspond to GIII. At the beginning of the twenty first century a forum was convened to establish an international collaboration to prepare the next generation of reactor technology (GIV). A number of design options were on the table (see below) among them molten salt reactors.

[...] In conclusion, the technical challenges of MSFR technology need to be considered. The molten fluorine based salts that are envisaged need to work at temperatures in the region 500 to 800˚C and containment vessels and pumps need to be designed which resist erosion, corrosion and the neutron flux from this high temperature salt. An MSFR requires a fuel reprocessing plant and for the Th cycle no such plant has thus far been designed built, tested and approved by safety authorities. Finally, there are well-understood safety protocols for GII and GIII reactors. The radical new approach offered by MSFR technology means that a whole new set of safe design principles needs to be developed.

At the end of the 1960s The Oak Ridge National Laboratory built and ran an experiment MSR-E designed to pave the way for the MSFR technology. The experiment ran for 4 years. Apart from that realisation, MSFR with a thorium-based fuel is a concept yet to leave the drawing board. It is worth pursuing, but the claimed virtues of near inexhaustible resource, enhanced safety, less waste and elimination of weapons proliferation still need to be demonstrated.

No comments:

Post a Comment