At this crucial juncture it is important to look past the debate between those that consider Greeks a chronically lazy folk and those that point the finger to the delusional policies enforced by the creditors. Five years have past since I created the graph below and so far little stock has been taken from it. Growth remains the absolute goal of economic science and practice; ultimately, all policies based on this predicate will fail.

Resource CrisisMarkets in general took a beating last Monday in the wake of the unexpected referendum, but sort of held from Tuesday onwards. The Brent index however, kept declining to its lower close since April, clearly breaking down from the plateau it formed in previous months. Bad news for the petroleum industry, particularly in the US, where so far the haunting prospect of a default wave has been kept at bay.

Greece: the bad apple of the bunch?

Ugo Bardi, 02-07-2015

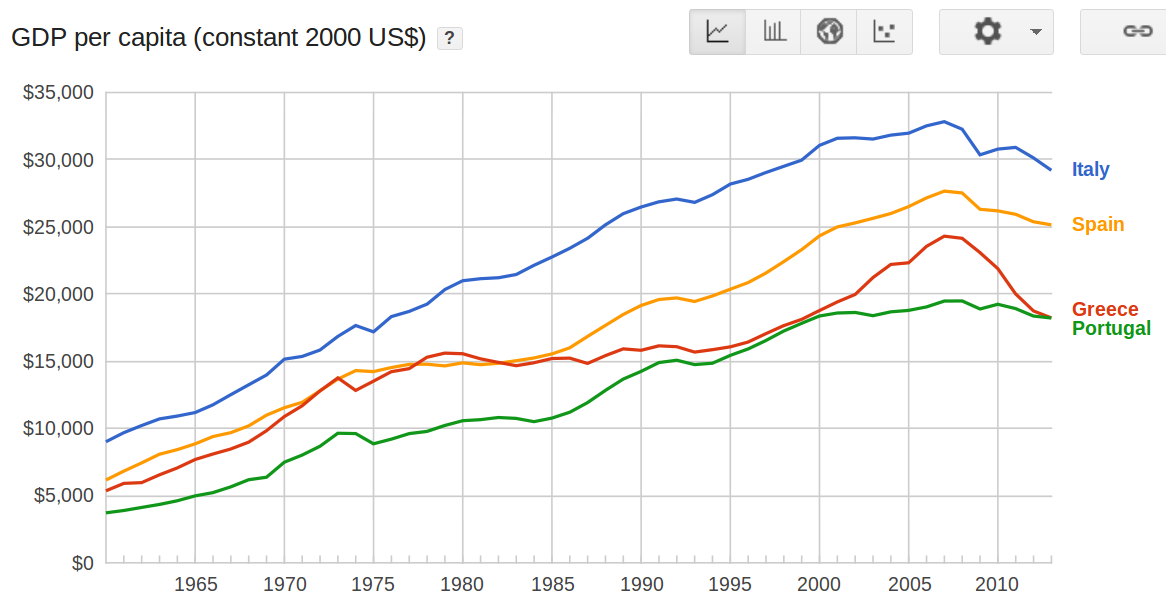

Unfortunately, the data tell a different story. Greece is not alone in having economic problems and all the Southern European countries tend to show similar trends. For instance in terms of GdP per capita, the Greek decline is sharper than that of the others, but not qualitatively different. (image from Google public data)

[...] As I wrote in an earlier post about Greece, financial factors may be simply a reflection of a much deeper trouble. And this trouble was already identified long ago in the study titled "The Limits to Growth", published in its first version in 1972. Note how the results of the "Limits" model (below taken from the 2004 version of the study) are similar to the decline observed in the GdP and the industrial production index of the southern European countries.

RigzoneTechnical analysis is pointing to another D-day for the so called "shale" industry. There have been a few before that went past without consequence, but the status quo can not hold forever.

On The Brink: Upstream Companies Increasingly Vulnerable To Collapse

Deon Daugherty, 29-06-2015

[...] Bob Gray, a partner in the energy transactions practice at Mayer Brown in Houston, used the monkey trap parable to illustrate what’s happening in the energy industry. Some companies fight the wisdom to sell assets or consider a merger during a profound downturn; instead they take on more debt they can’t afford in an effort to stay afloat. In the end, they lose everything.

[...] To be sure, Kim Brady, a partner at SOLIC Capital in Illinois, said that almost two dozen public companies have leverages higher than six times. Couple that with the fact that those companies may not have the best assets – which makes production more expensive – and you’ve got a steady stream of companies that are spending more money than they are making.

“Some of them will have challenges in terms of meeting the debt service in 2016 and 2017,” he said.

While there has been a handful of companies seeking bankruptcy protection this year, that pace is expected to pick up during the next 18 months as more debt and interest payments become due.

BloombergStill in the US, there is a growing discrepancy in extracted volumes reported by different institutions that is becoming noticeable. Financing prospects are certainly not the same for an industry declining as a whole.

Shale Drillers' Safety Net Is Vanishing

Asjylyn Loder and Bradley Olson, 02-07-2015

The insurance protecting shale drillers against plummeting prices has become so crucial that for one company, SandRidge Energy Inc., payments from the hedges accounted for a stunning 64 percent of first-quarter revenue.

Now the safety net is going away.

The insurance that producers bought before the collapse in oil -- much of which guaranteed minimum prices of $90 a barrel or more -- is expiring. As they do, investors are left to wonder how these companies will make up the $3.7 billion the hedges earned them in the first quarter after crude sunk below $60 from a peak of $107 in mid-2014.

[...] The hedges staved off an acute shortage of cash for shale companies and helped keep lenders from cutting credit lines, many of which are up for renewal in October. With drillers burdened by interest payments on $235 billion of debt, $89 billion of it high-yield, a U.S. regulator has warned banks to beware of the “emerging risk” of lending to energy companies.

OilPrice.comAnother country deeply affected by present petroleum prices is Brasil. The pre-salt resources are pretty much left on ice, so to say. The impact in expected extracted volumes is dramatic.

EIA Data Still Doesn’t Add Up

Leonard Brecken, 30-06-2015

As initially pointed out by Peakoilbarrel.com in a recent article, discrepancies between actual data for oil production in Texas vs. what the EIA claims are so stark it’s almost scary. How this can be overlooked by the mainstream media as well as by most of the broker community is even more alarming. Further, how the U.S. oil industry fails to catch it and question it given that their livelihood is tied to it is even scarier.

[...] Comparing these figures with Texas RRC figures off their website, the differences are startling. First, the chart below clearly shows the trend through 4/1/15 as being flat to down, as production nosedived in April by nearly 15 percent, compared with the previous month, and 15 percent from end of 2014.

Yes, these numbers bounce around but, plotting the monthly data below, the trend is clearly down, not up. So the first question is: what prompted the EIA to boost expectations recently, starting in March, when the data is clearly flat in the largest region of EIA growth expectations?

OilPrice.comMidweek news emerged of another break down in gas trading between Gazprom and Ukraine. This time it seems Kiev took initiative consciously, now intended to acquire gas from its western neighbours - that is extracted in Russia.

Brazil A Victim Of Oil Prices And Its Own Hype

Nick Cunningham, 29-06-2015

[...] The collapse in oil prices is sapping the company’s revenues. High costs and the complexity of tapping presalt oil prompted a more modest assessment last year. In September 2014, Brazil lowered its forecast to 4 mb/d in oil production by the end of the decade. But even that now looks unrealistic. The bribery scandal that emerged in late 2014 and embroiled top officials at Petrobras and the ruling Workers’ Party began to hollow out the company’s balance sheet.

Petrobras is the most indebted oil company in the world, with total debt reaching $124 billion as of the first quarter of 2015. The mounting toll of low oil prices coupled with the epic scandal plaguing the company – causing a broader malaise across Brazil’s entire economy – has dimmed the prospects of Brazil’s most important company. Earlier this year, Moody’s downgraded Petrobras’ credit into junk territory after the oil company struggled to even get a handle on the final financial bill resulting from the scandal.

Petrobras has since tried to put its troubles behind it, but the damage has been done. On June 29, Petrobras announced a 37 percent cut in capital spending, with a plan to spend $130 billion over the next five years instead of the initially proposed $206 billion. It will also increase its level of planned asset sales in order to raise cash. Lower spending will result in a rather deep reduction in what Petrobras thinks it will be able to produce – 2.8 mb/d by 2020. That will result in scaled-down expectations for both Petrobras and Brazil as a world oil producer.

Deutsche WellaPast October, Ukraine's western neighbours are unlikely to have enough volumes to supply the war torn country. This could be just another bluff manoeuvre that general Winter will eventually set straight.

Russia halts gas supply to Ukraine after pay dispute

01-07-2015

In a statement released Wednesday, Gazprom said "Ukraine did not pay for July gas supplies," and as a result, the company would be "halt[ing] gas supplies to Ukraine from 10:00 am (0700 UTC) July 1."

The head of the Russian gas export company, Alexei Miller, told state media the shutoff was affected because Ukraine would not prepay for new supplies.

Without an advance payment Gazprom said "no more gas would be sent to the conflict-torn ex-Soviet country."

Russia reportedly offered to retain the same price for gas as during the second quarter of 2015 - $247.17 (221 euros) per thousand cubic meters of gas - an offer Ukraine failed to accept.

PoliticoNegations over Iran's Nuclear programme drag on, with the press floating contradicting predicaments on its ultimate outcome. Hopefully, this is another theme soon to reach a conclusion.

Ukraine-Russia gas conflict flares

Kalina Oroschakoff, 01-07-2015

[...] Now Ukraine can receive sufficient gas supplies from Slovakia, Hungary and Poland to make up for the missing 7 billion cubic meters of Russian gas it needs between now and October. “Today we have a strong mechanism of reverse flows, much better prepared in terms of energy supplies,” said Šefčovič. “We have the capacity, the time and the gas, to make sure there is adequate supply.”

But the country will need Russian gas imports to cover its winter needs, an EU source said. That is also why the EU is keen to have a package in place before then, to ensure stable supplies between the countries.

Failing to reach a deal Tuesday also means that gas relations between Russia and Ukraine are again governed by a controversial 2009 supply contract whose terms are being looked at by the International Arbitration Court in Stockholm. Under that contract, Ukraine would now have to pay $291 per thousand cubic meters, said an EU source.

ReutersIn Germany another early closure of a nuclear power plant was perceived with great symbolism. In reality, the large part of the German Nuclear fleet is set to close only by 2022. With both the CDU and the SPD dragging their feet on renewable energy, it might well be the case that by then their closure is no longer practical.

No breakthrough at Iran nuclear talks, ministers push for deal soon

Parisa Hafezi and Arshad Mohammed, 02-07-2015

Tehran and world powers were still shy of a breakthrough at nuclear talks on Thursday as foreign ministers flew in to help push for a swift deal and resolve disputes over how sanctions could be lifted and how Iran's compliance would be monitored.

Iran is in talks with the United States and five other powers - Britain, China, France, Germany and Russia - on an agreement under which it would curtail its nuclear program in exchange for relief from economic sanctions.

French Foreign Minister Laurent Fabius said some progress had been made and that he would return to Vienna on Sunday evening in the hope of clinching a final deal to end a 12-year standoff between Iran and the West.

Chinese Foreign Minister Wang Yi said there was a "high possibility" Iran and the six would succeed in reaching an accord in the coming days, though he cautioned that there were still difficult issues to resolve.

Deutsche WellaThe newest strategy by the PP government to tame the growth of decentralised renewable electricity in Spain has meet great public opposition. Having citizens mobilised towards sustainable energy policies can only be taken as a good thing.

Germany's oldest remaining nuclear reactor shut down

28-06-2015

Germany's Grafenrheinfeld reactor, the country's oldest remaining nuclear plant, has been decommissioned. It's part of a move to eliminate all nuclear power plants operating in the nation by 2022.

The plant was taken offline at one minute to midnight on Saturday night, after having operated for more than 30 years. Grafenrheinfeld, in the north of the German state of Bavaria, first went into service in 1981, and has produced more than 333 billion kilowatt-hours of electricity.

It is the first reactor to close since Germany shut down the oldest eight of its 17 plants in 2011, just prior to the Fukushima meltdown in Japan. Germany will next switch off one of two reactors at the neighboring Gundremmingen plant. It plans to shut down all nuclear power plants in the country by 2022.

GreenTechMediaRecently, I have been warning in various fora against taking at face value the figures published by BP in its yearly review of world energy. Presently, solar energy is possibly the weakest time series, perhaps missing the energy generated by entire technological sectors. The news below points to this deficiency to be considerably larger.

Anger Grows Over Spanish Law Designed to Halt Residential Storage

Jason Deign, 29-06-2015

[...] Earlier this month, the Spanish Ministry of Energy proposed legislation that would tax owners of solar-plus storage systems $10 per kilowatt of capacity. The proposal has upset many people in the country.

The energy ministry website set up to collect comments on the proposed law crashed after more than 100,000 petition signatures and 34,000 formal objections had been sent in. Two days after the closing date for comments, an Avaaz petition to kill the law had surpassed 180,000 signatures and was continuing to grow.

A separate petition asking for the resignation of José Manuel Soria, the minister of industry, energy and tourism, had gathered 153,000 signatures.

Scientific AmericanTwo days of relative calm are head with the weekend. What happens next is anyone's guess. Enjoy the sunshine.

U.S. Solar Is Producing 50 Percent More Electricity Than We Thought

Melissa C. Lott, 01-07-2015

Actual solar electricity production in the United States is 50% higher than previous estimates, according to new analysis by the Solar Energy Industries Association (SEIA) and kWh Analytics.

All told, analysts found that solar energy systems in the U.S. generated 30.4 million megawatt-hours (MWh) of electricity in the 12 months ending in March 2015. Three states - California, Arizona, and Hawaii – can now say that solar provides more than 5% of their total annual electricity demand.

The new estimate includes generation from behind-the-meter solar systems, which is not included in estimates produced by the Energy Information Administration (EIA). The EIA uses solar power generation information collected with their Form 923 survey, which only applies to utility-scale power plants that have more than 1,000 kW in solar generation capacity (i.e. are larger than 1,000 kWac). Given that the average solar PV system that you will find on the rooftops of houses in the U.S. has just 5 kWac of generation capacity, the electricity that they produce is not captured in EIA statistics.

No comments:

Post a Comment